This Earnings Press Release should be read in conjunction with the Audited 2020 Consolidated Financial Statements for the year ended 31 December 2020. This Earning Press Release is also available on our website at https://www.cscs.ng. This analysis is dated 15 April 2021. Unless otherwise indicated, all amounts are expressed in Nigerian Naira and have been primarily derived from the Group’s Consolidated Financial Statements, prepared in accordance with the International Financial Reporting Standards (“IFRS”). The accounting policies used in the preparation of these Consolidated Financial Statements are consistent with those used in the Group’s Audited 2019 Financial Statements for the year ended 31 December 2019. Additional information relating to the Group is available on the Company’s website; https://www.cscs.ng.

LAGOS, NIGERIA – April 15, 2021 – Central Securities Clearing System Plc (“CSCS”, the “Company” or the “Group”), (NASD Ticker: SDCSCSPLC) announced its Audited 2020 Financial Results. Amidst unprecedented economic and financial market conditions occasioned by the COVID-19 pandemic, the Group grew total income by 31.3% year-on-year (YoY) to N12.09 billion. With profit after tax of N6.93 billion, an incredible 41.4% year-on-year growth, translating to N1.39 earnings per share, the Group delivered 20.3% return on average equity for the 2020 financial year, compared to 15.3% in 2019FY.

Highlights:

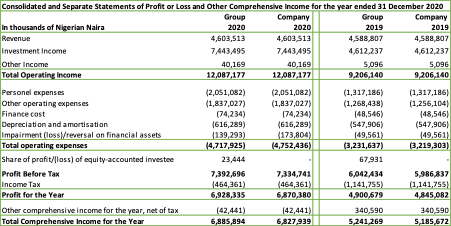

Income Statement

- Total Income: N12.09 billion, compared to N9.21 billion in 2019FY (31.3% YoY growth).

- Investment Income: N7.44 billion, an impressive 61.4% YoY growth, compared to N4.61 billion in 2019FY.

- Operating Expenses: N4.72 billion, compared to N3.23 billion in 2019FY (46.0% YoY growth), partly reflecting investments in technology and human capital.

- Profit Before Tax: N7.39 billion, a 22.3% YoY growth, compared to N6.04 billion in 2019FY.

- Profit After Tax: N6.93 billion, compared to N4.90 billion in 2019FY (41.4% YoY growth).

- Return on Average Equity (ROAE): 20.3%, compared to 15.3% in 2019FY.

- Earnings Per Share (EPS): 139 Kobo, compared to 98 Kobo in 2019FY (41.8% YoY growth).

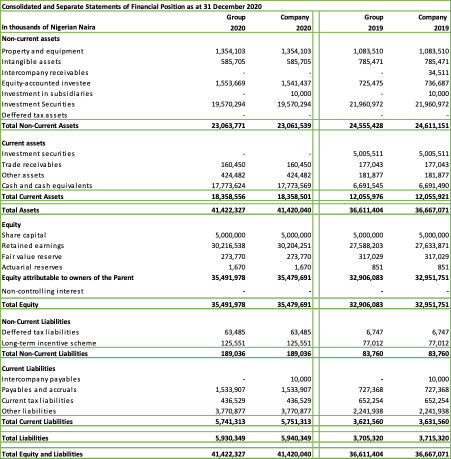

Balance Sheet

- Total Assets: N41.42 billion, compared to N36.61 billion as at 2019FY (13.1% YoY growth).

- Property, Plant and Equipment (plus intangibles) grew 25.0% YoY to N1.35 billion, reflecting continued investments in infrastructure to enhance operational efficiency and resilience.

- Shareholders’ Funds: N35.49 billion, up 7.9% YoY; reflecting strong capacity for organic capital growth.

Commenting on the Group’s performance, Mr. Oscar N. Onyema OON, the Chairman, Board of Directors of CSCS, said;

“It is exciting to report these stellar results. Defying the unprecedented challenges that characterised 2020 financial year, CSCS emerged stronger, delivering outstanding growth in top and bottom-lines, and executing far-reaching initiatives that would sustainably strengthen the competitiveness and resilience of the business. Having grown profit by over 41% in such a challenging year to deliver 20.3% return on average equity, the Board of Directors and Management are upbeat about the value accretive prospects of CSCS, and we are enthusiastic that the progress made thus far in repositioning the business to efficiently play a more active and leading role in deepening the Nigerian capital market will be sustained. With continuous investments in new technologies, talent, and work environment, we are optimistic on the productivity of CSCS going forward. Subject to shareholders’ approval at the upcoming annual general meeting, the Board is recommending a dividend of N5.85 billion or dividend per share of N1.17, representing a growth of 36% over the N0.86 dividend per share paid from the 2019 financial year earnings.”

While commenting on the Group’s results, Mr Haruna Jalo-Waziri, the Chief Executive Officer, said;

“Amidst the COVID-19 twin threat to lives and livelihoods, and more importantly the attendant challenges in economic and business environment, we outperformed budget, reinforcing our commitment to delivering superior value to our shareholders, irrespective of the odds. These impressive results reflect our enhanced collaboration with different stakeholders and their unflinching support and loyalty to CSCS, as the core infrastructure for the Nigerian capital market. Hence, my colleagues and I are excited to dedicate this performance to our esteemed participants, regulator and the Board of Directors, whose support kept us stronger through the pandemic. We would continue to invest in our collective objective of deepening the capital market and broader financial system, even as we seek new and efficient ways of enhancing our partnerships for mutual prosperity. Having laid a solid foundation over the past three years, we are more than ever optimistic on the prospect of our business, especially as we diversify the business for enhanced resilience against macro and market volatilities. We will sustain our disciplined cost efficiency culture, in our commitment to delivering sustainable value to shareholders over the long term. We are excited at the 39.0% cost-to-income ratio, despite the impact of exchange rate volatilities and rising headline inflation on our cost base. The years ahead look challenging, albeit more promising than ever, as we reinforce our commitment to leveraging best-in-class technologies and our continuous investments in human capital in delivering value to all stakeholders.”

Also commenting on CSCS’ financial performance, the Chief Financial Officer, Mr. Peter O. Medunoye noted;

“We recorded impressive double-digit growth in revenue and profitability, and more importantly recorded continuous improvement across all key performance indicators. We recorded decent growth in income from our CSD and ancillary services whilst also leveraging our ingenuity in effectively positioning the proprietary investment portfolio for growth. Delivering 17.7% and 20.3% return on average assets and return on average equity respectively, we are excited at the capacity of the business in generating internal capital to fund the exciting growth ahead.”

About CSCS

The Central Securities Clearing System (CSCS) is a Public Limited Company, with a diversified shareholder base, including the Nigerian Stock Exchange, some of the largest banks in Nigeria, private equity firms, investment banks and other corporate and individual shareholders. With over two decades of operation, serving as the Central Securities Depository for the Nigerian capital market, CSCS has been pivotal to the growth and transformation of the capital market, including its audacious full dematerialization of share certificates and the shortening of settlement cycle in the capital market. CSCS serves as the central depository for equities, commercial papers, corporate bonds, sub-national bonds, certain sovereign bonds, equity-traded funds, real estate investment trusts, mutual funds and commodities. CSCS is licensed and regulated by the Securities and Exchange Commission (SEC). The activities of CSCS are governed by the Investment and Securities Act 2007, the Companies and Allied Matters Act 2004, and the SEC Rules.

For enquiries, contact:

Charles I. Ojo

Company Secretary